Looking into personal loans can get confusing fast when terms like debt-to-income ratio and credit utilization keep appearing without any clear explanation. If your credit card balances or monthly debt payments already feel heavy, the wrong ratio can make borrowing harder before you even apply. Getting familiar with what these numbers say about your situation is the first step toward getting options that actually work for you.

What is your debt-to-income ratio?

Your debt-to-income ratio shows how much of your gross monthly income (your income before taxes and deductions) goes toward monthly debt payments. It’s a simple ratio that helps lenders see if your debt payments add pressure to your budget or if you have room to take on loans or credit without stretching your finances too thin.

A good debt-to-income ratio signals that you’re managing the amount of debt you have compared to what you earn. This is one of the factors in your credit score, and while it doesn’t appear directly on your credit report, it still shapes how lenders view your ability to handle the total monthly debt payments you already carry.

How Debt-to-Income is Calculated

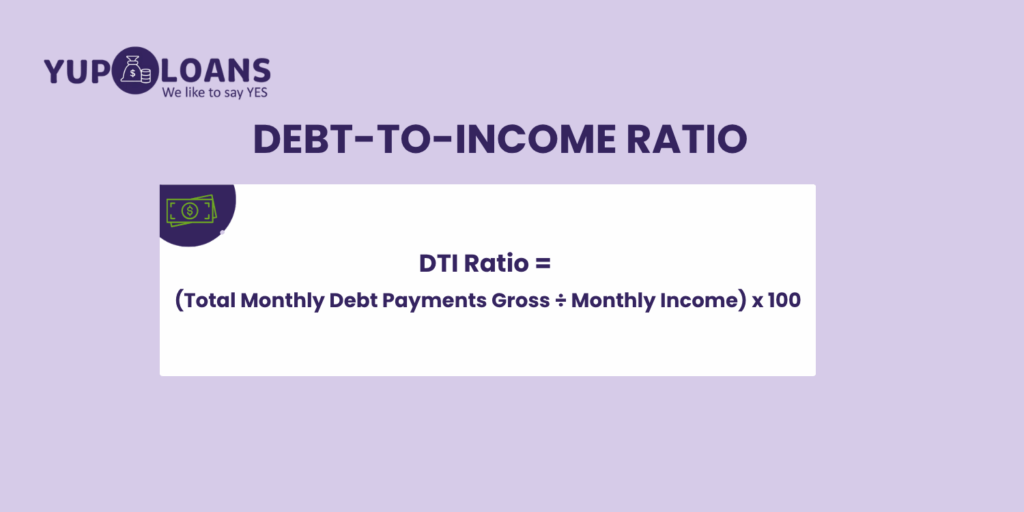

The debt-to-income ratio (often called your DTI ratio) is worked out using this formula:

DTI Ratio = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100

Debts That Are Counted in Your DTI Ratio

Lenders will include any of these debts in your DTI ratio:

- Credit card minimum payments

- Credit card balances that require monthly payments

- Auto loans

- Student loans

- Personal loans

- Mortgage payments

- Installment loans of any kind

- Any other recurring monthly debt payments

Debts That Are Not Counted in Your DTI Ratio

Lenders usually don’t factor in:

- Groceries, fuel, or everyday spending

- Utilities or phone bills

- Insurance premiums

- Subscriptions or memberships

- Any spending that isn’t tied to a loan or required monthly repayment

What is your credit utilization ratio?

Your credit utilization ratio (CUR) shows how much of your total credit you’re using on revolving credit accounts. Revolving credit is any account where you can borrow, repay, and borrow again up to a set credit limit, like a credit card or a line of credit. Because these balances change as you spend and pay them down, they’re a key part of how lenders see your day-to-day credit health.

This ratio is one of the most influential factors in your credit score, because it reflects how you manage the amount of credit you’re using compared to your total credit limit.

Keeping your credit utilization below 30% is a common guideline, but when money is tight or you rely on two credit cards, the ratio can climb quickly.

How the Credit Utilization Ratio is Worked Out

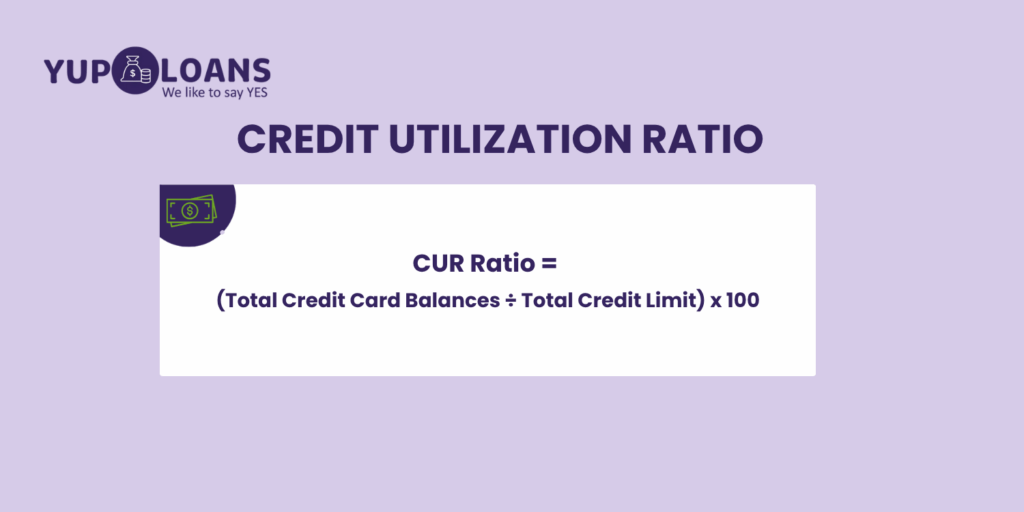

The CUR is worked out using this formula:

Credit Utilization Ratio = (Total Credit Card Balances ÷ Total Credit Limit) × 100

Balances That Count Toward Your Credit Utilization

Lenders use these amounts when working out your CUR ratio:

- Your current credit card balances

- Balances across all credit card accounts

- Any revolving line of credit tied to a total credit limit

- The total amount of credit being used across your open accounts

- Any balance that reduces your available credit

These all contribute to how much of your total available credit you’ve used, and whether you’re keeping your credit utilization below 30% or drifting higher.

Balances That Do Not Count Toward Credit Utilization

These items aren’t included when lenders look at your credit utilization rate:

- Auto loans, personal loans, or a mortgage

- Any installment loan that doesn’t involve revolving credit

- Everyday spending not tied to a credit line

- Bills that aren’t linked to credit accounts

- Any payment that doesn’t sit on your credit card

Even if these payments affect your budget, they don’t change your credit utilization because they don’t draw from a credit limit.

DTI Ratio vs CUR At A Glance

Here’s a quick way to see how the debt-to-income ratio and credit utilization ratio differ and what each ratio tells a lender. Both matter, but each one looks at a completely different part of your finances.

| Category | Debt-to-Income Ratio (DTI) | Credit Utilization Ratio (CUR) |

| What the ratio looks at | Your monthly debt payments compared to your gross monthly income | How much of your credit limit you’ve used on credit cards and revolving credit accounts |

| Ratio is the percentage of… | Debt payments to your gross income | Available credit you’ve used |

| What affects the ratio | Your total monthly debt payments, including auto loans, student loans, personal loans, mortgage payments, and minimum credit card payments | Your credit card balances, total credit limit, and the amount of credit you’re using |

| Where it shows up | Not listed on your credit report, but lenders review it during applications | Affects your credit score, because credit use is one of the most influential factors in your credit report. |

| How it impacts borrowing | If the ratio is higher, lenders might see it as a sign that you have too much debt for your income | High credit use can directly impact your credit score and reduce your available credit, making it harder to get approved |

| Typical lender preference | A lower DTI makes it easier to take on additional debt | Lower credit use – ideally, credit utilization below 30% |

How DTI & CUR Impact Your Credit Score & Your Loan Options

Your debt-to-income ratio and your credit utilization ratio influence your finances differently, but both can shape how lenders view your application for loans or credit.

The DTI ratio doesn’t show up on your credit report, yet lenders use it to judge if your monthly debt payments take up too much of your income. If your ratio is higher, it signals that your current debt leaves little room for new commitments.

Your credit utilization works in the opposite way because it feeds directly into your credit score. High credit card balances against a small total credit limit can impact your credit score fast. The amount of credit you’re using is one of the most influential factors in your credit health, and when your balance rises close to your limit, your available credit shrinks, which can make approvals harder.

An Example of How DTI and CUR Work

Let’s say you earn $3,000 gross monthly income. Your monthly debt payments include a $300 auto loan, a credit card minimum payment of $50, and a $150 personal loan. That puts your total monthly debt payments at $500.

Your DTI ratio would be:

$500 ÷ $3,000 × 100 = 16.6%

Now consider your credit utilization. If you have two credit card accounts with a combined total credit limit of $2,000 and your credit card balances add up to $1,200, your credit utilization is:

$1,200 ÷ $2,000 × 100 = 60%

In this example, your DTI ratio looks strong, but your credit utilization is high. Even with manageable overall debt, a 60% utilization rate can directly impact your credit score and make borrowing more expensive.

How to Lower Your Debt-to-Income Ratio

Even small changes can help you lower your DTI, improve affordability, and create more room in your budget.

1. Pay Down Debt in Small, Steady Amounts

You don’t need to clear big balances all at once for your DTI ratio to improve. Each time you pay down debt, your monthly debt payments shrink, which lowers the ratio even if your income stays the same. Use the debt avalanche method to target the debts with the highest monthly payment first if you want the biggest impact.

2. Avoid Taking on Additional Debt

If your DTI ratio is already tight, taking on additional debt can make the ratio jump quickly. Holding off on new credit while you work on your existing balances helps keep your debt payments to your gross income manageable.

3. Increasing Your Income

Any income increase helps the ratio straight away because it changes the “income” part of the formula. This might include overtime, a temporary second job, or any short-term earnings that raise your gross income. Even a small increase can lower your DTI ratio enough to widen your borrowing options.

4. Extend a Loan Term if Needed

Some lenders let you stretch out a repayment plan. A longer term lowers the monthly debt payments, which reduces the ratio. You’ll pay more interest over time, but it can improve affordability in the short term.

How to Improve Your Credit Utilization Ratio

Improving your credit utilization ratio can make a noticeable difference to your credit score, because it shows lenders you’re not relying too heavily on your credit card or other revolving credit. Since this ratio is the percentage of your available credit you’ve used, even small changes can quickly change your credit score.

1. Make Extra Payments When You Can

Paying your credit card balances more than once a month helps keep the amount of credit you’re using lower when your lender reports to the credit bureaus. This can help improve your credit score faster, especially if you’ve been close to your total credit limit.

2. Time Payments Before the Statement Closes

Your credit utilization rate is often recorded on your statement date, rather than on your due date. Paying a portion early keeps the percentage of your income tied to credit card usage lower when it’s reported.

3. Ask for a Higher Credit Limit

If your income allows it, a higher total credit limit spreads the same balance across more available credit. This lowers the ratio instantly without changing how much you owe. Just avoid adding new credit or spending more, or you’ll undo the benefit.

4. Spread Balances Across Credit Accounts

If one credit card is close to the limit but you have room on another, try moving some of the balance to lower your ratio on the account that matters most. This works well when you have two credit cards or more, as it prevents one card from being maxed out.

5. Avoid Closing Old Cards

Closing an account reduces your total amount of credit, which can raise the ratio even if you don’t change your spending. Keeping older credit accounts open also helps with the length of your credit history, which is another factor in your credit score.

6. Try Not to Max Out Your Credit

Using too much of your total available credit can signal high credit usage to lenders. Keeping your credit utilization below 30% gives you more room to manage unexpected expenses while protecting your credit health.

When Debt Consolidation Might Help

Debt consolidation means moving several debts into one new loan with a single monthly payment. It can help when both your DTI ratio and your credit utilization ratio are working against you, for example, if high credit card balances are pushing your credit utilization up while multiple payments are pushing your monthly debt higher.

It can help when:

- Your credit card use is high enough to affect your credit score,

- Your monthly debt payments are large enough to make your ratio climb,

- Or you want a single, predictable payment instead of managing multiple balances.

Instead of spreading payments across credit card accounts with tight limits, consolidation pauses your revolving credit use, increases your available credit, and turns unpredictable bills into a single, steady amount.

How Yup Loans Helps Borrowers With Bad Credit

If your debt-to-income ratio or your credit utilization is higher than you’d like, it doesn’t mean you’re out of options. Yup Loans works with lenders who look beyond a single ratio and consider your wider financial situation, including your income, banking history, and how you manage your overall debt.

With one secure form, you can be matched with lenders who offer personal loans from $250 to $3,000, often with decisions in minutes¹. There are no upfront fees, no long applications, and no judgment based on past credit issues. Whether you’re trying to get on top of credit card use, manage your monthly debt payments, or create space in your budget long-term, our lending partners aim to give borrowers fair access to the loans or credit they need. Get started by requesting funds today.

FAQs About DTI & CUR

Can you get a loan with a high DTI or high credit utilization?

A high DTI ratio or a high credit utilization rate can make approvals harder, but many lenders, especially those outside traditional banks, look at more than one ratio when reviewing applications. Your income stability, banking history, and how you’ve handled your existing debt all play a part in the final decision.

Can you improve DTI and CUR at the same time?

Paying down revolving balances lowers your credit utilization ratio, and paying off any loan that has a high monthly bill can improve your DTI ratio. Some borrowers see both numbers improve at once when they focus on reducing credit card use and keeping their monthly debt payments manageable.

How fast can DTI and CUR ratios improve?

Your credit utilization can improve as soon as your lender reports a lower balance – often within a few weeks. Your DTI ratio takes longer to shift because it depends on reducing the monthly debt you owe or increasing your income, but even small changes can help the ratio move in the right direction.

Does keeping old credit cards open hurt my DTI?

Your debt-to-income ratio only includes your monthly debt payments, not your unused credit limits. If a card has a $0 balance, it adds nothing to your DTI. Keeping older credit accounts open can even help your credit utilization by raising your total credit limit, and it supports the length of your credit history without changing your DTI at all.