Home Renovation Loans

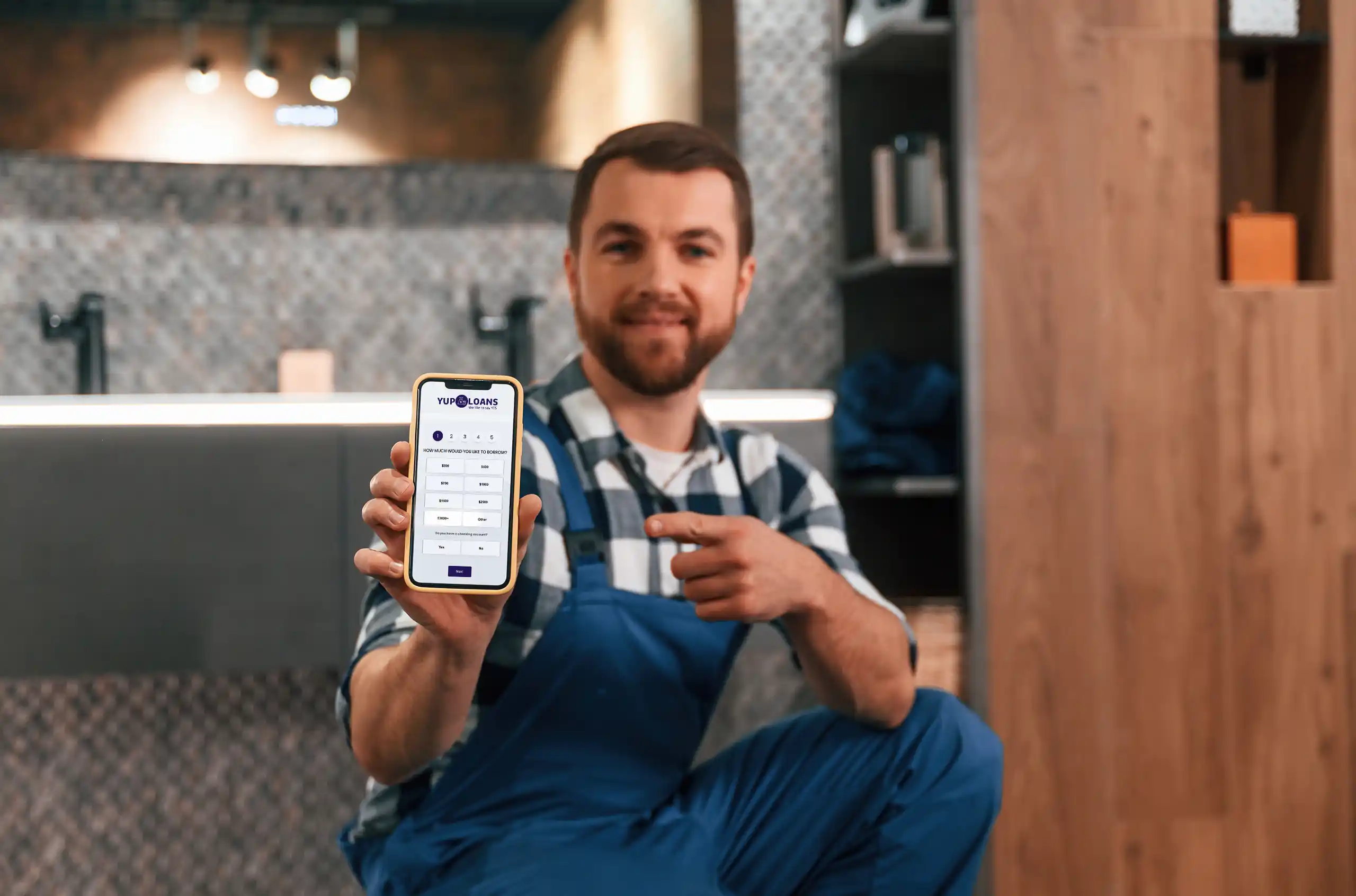

Turn your house into the dream home you’ve always wanted. With Yup Loans, you can find home renovation loans up to $3,000, even if your credit isn’t perfect.

No fees for using Yup Loans

Apply online in minutes, anytime

Quick loan decisions in 3 minutes¹

Borrow from $250-$3,000

Representative Example: $1,000 loan over a 12-month term would have a total cost, including interest, a total payback amount of $1,134.72. APR 29.82%. Rates between 5.99% APR and 35.99% APR for qualified customers2. Loan term lengths from 3 to 36 months for qualified consumers.

Why Choose Yup Loans for Home Renovation Loans?

Simple Online Process

Applying for an unsecured home improvement loan shouldn’t slow your project down. With Yup Loans, completing our secure form only takes about 3 minutes¹. No stacks of paperwork, no multiple applications, just one quick step that connects you with lenders ready to help.

Funds When You Need Them

Upgrading a kitchen, refreshing a bathroom, or adding new flooring all takes planning – and timing matters. Once approved, your money could be deposited as soon as the next business day*. That means you can move forward with your project without unnecessary delays.

Designed for Bad Credit Borrowers

Many traditional lenders overlook borrowers with past financial challenges. Our network is different as we work with lenders who focus on your ability to repay today³. Even if your credit history isn’t perfect, you still have personal loan options to fund the upgrades you’ve been planning.

How Home Renovation Loans Work

Home renovation loans through Yup Loans are personal installment loans up to $3,000. They’re designed for planned projects that improve or upgrade your living space.

When you apply, we match you with lenders who provide clear loan terms, including the repayment schedule, interest rate, and total cost. If approved, you’ll make predictable monthly payments over a set period of between 3 and 36 months.

Because they are unsecured loans, you don’t need to use your home or any other asset as collateral. Once you accept an offer, funds could be in your account as soon as the next business day*, giving you the flexibility to get started on your renovation project right away.

Get a Home Improvement Loan in 3 Simple Steps

1

Complete Our Quick Form

Share a few basic details – it only takes approximately 3 minutes¹.

2

Review Your Personal Loan Offer

If approved, you’ll see the loan terms upfront, including repayment timeline and total cost.

3

Get Your Home Renovation Financing

Once you accept, the money could be deposited into your bank account as soon as the next business day*.

Home Improvement Projects You Can Use the Loan For

Home renovation loans are for planned projects that make your home more comfortable, functional, or valuable. Whether you’re updating a single room or tackling a larger renovation, you can use your personal loan for nearly any upgrade, including:

- Kitchen updates like new countertops, cabinets, or appliances

- Bathroom upgrades like fixtures, tiling, or a new vanity

- Installing new flooring or carpeting

- Energy-efficient windows, doors, or appliances

- Fresh paint, lighting, or interior design updates

- Landscaping, patios, or building a small deck

- Adding a hot tub, jacuzzi, or above-ground swimming pool

- Installing new gates or fencing

- Upgrading with an electric garage door

- Partial basement or attic improvements like flooring or insulation

- Adding storage solutions or built-in shelving

Reviews

Tanya, Denver, CO⁵: “We were halfway through updating our kitchen, but we ran out of money before finishing. Through Yup Loans, we found a lender who approved us quickly, and we were able to add new countertops and appliances to complete the look. It made the whole renovation feel worthwhile.”

Chris, Dallas, TX⁵: “We’d been saving to upgrade our backyard and add a small deck, but we were still short. Yup Loans helped us find a lender who worked with our credit history. The installment plan made it easy to manage, and we’re enjoying our new outdoor space already.”

Home Renovation Loans FAQs

Can I get a home renovation loan with bad credit?

Many lenders in our network work with borrowers with poor or limited credit histories³. Instead of focusing only on your credit score, they consider your current income and ability to repay.

What’s the difference between renovation loans and repair loans?

Renovation loans are for planned upgrades and improvements, like new flooring, a bathroom upgrade, or adding a deck. Home repair loans cover urgent fixes, like replacing a broken furnace or repairing storm damage.

Do I have to own the home to take out a home remodelling loan?

Renovation loans are personal loans, so approval is based on your income and ability to repay. You can use them to fund upgrades if you own your home, rent, or share living space.

Do I need collateral to apply for a home improvement loan?

Renovation loans through Yup Loans are unsecured personal loans, so you don’t need to put up your home or other assets as security.

Is it better to use credit cards or a home renovation loan?

Credit cards can be convenient for smaller purchases, but they often come with a high annual percentage rate (APR). If you carry a balance, those interest charges can quickly add up.

A home renovation loan gives you a set loan amount and a clear repayment schedule. Most lenders provide loan options with a fixed interest rate, so your monthly payments stay the same until the loan is paid off. That predictability often makes installment loans more manageable than revolving credit.

If you’re planning upgrades that cost more than you can comfortably pay off in a single billing cycle, a renovation loan could help you secure the lowest rate available for your situation and spread the cost out over time. This way, you avoid racking up interest on multiple credit cards while still finishing your project.

Get a Renovation Loan Today

Don’t put your renovation plans on hold because of credit challenges or long bank delays. With Yup Loans, you can connect to lenders who provide personal installment loans up to $3,000, with terms that work for your budget.

Completing our secure online form only takes roughly 3 minutes¹, and if approved, you could see funds as soon as the next business day*.