Home Repair Loans for Bad Credit

Struggling with a leaky roof or broken A/C, but worried your credit score might hold you back? Whether you’re fixing urgent storm damage or dealing with essential repairs, we make it easier to secure the funds you need3, quickly, simply, and without judgment.

Get a decision in 3 minutes

Apply online

Applications open 24/7

No upfront fees or costs

Representative Example: $1,000 loan over a 12-month term would have a total cost, including interest, a total payback amount of $1,134.72. APR 29.82%. Rates between 5.99% APR and 35.99% APR for qualified customers2. Loan term lengths from 3 to 36 months for qualified consumers.

Why Choose Yup Loans for Home Repair Loans

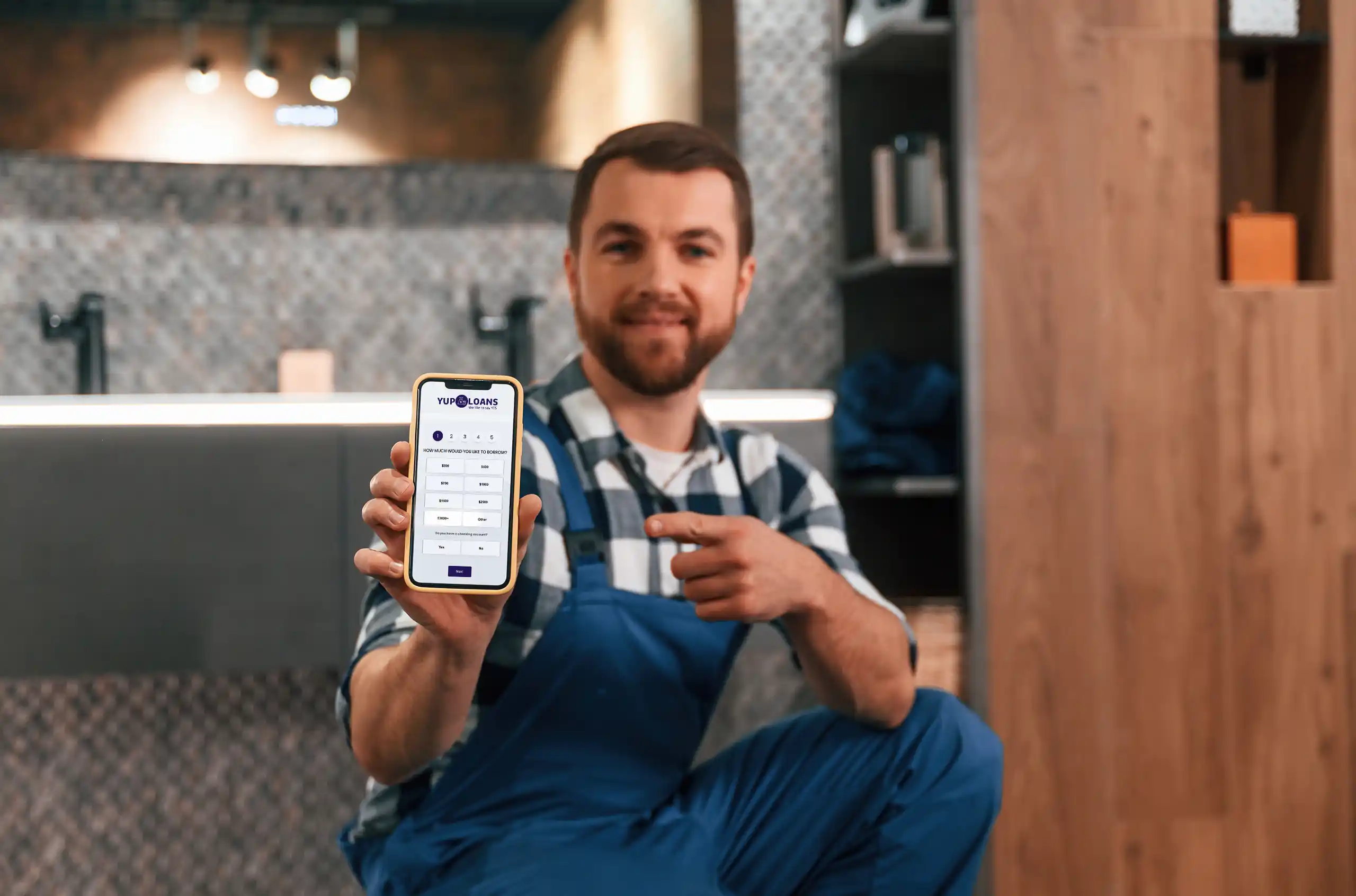

Quick & Easy Application

Our simple online form takes just minutes to complete1. No paperwork, no stress. Get matched with lenders who offer unsecured home improvement loans for bad credit, even if you’ve been turned down elsewhere3. Applications are open 24/7, so you can apply when it suits you.

Fast Access to Funds

Our service is designed to help you act fast in home emergencies. When your heating breaks or you’ve got a leak, you can’t wait weeks for help. Once approved, your cash could be sent within 15 minutes*.

Personal Loans for Bad Credit

Unlike traditional banks, we work with lenders who understand that credit history isn’t the full picture. Whether you’ve had late payments, defaults, or other credit challenges, we’ll connect you with lenders who like to say yes3.

How Home Repair Loans Work

Home repair loans give you access to quick funds when urgent fixes can’t wait. Whether you’re facing water damage, electrical faults, or structural issues, these loans help bridge the financial gap so you can carry out essential repairs.

Yup Loans has a fully online process that is free from paperwork and delays. Simply fill out our secure form, and we’ll connect you with lenders who consider all types of credit backgrounds3.

Once you accept a loan offer, funds are typically sent directly to your checking account, often by the next business day*. You’ll know the repayment schedule upfront, so you can plan your finances without surprises4.

3 Easy Steps to Get a Home Repair Loan with Bad Credit

1

Quick Application

Fill out our online form in under 3 minutes¹. We’ll match you with lenders who provide unsecured personal loans for people with poor credit3.

2

View Your Offer

Look over the loan terms and make sure they work for your budget4. You’re not locked in – only accept the loan if it works for you.

3

Get Funded

Once you agree to the terms, the funds can be deposited directly into your account as soon as the next business day*.

You Can Use a Home Repair Loan For:

Home repair projects don’t wait for perfect credit, and with the right loan, you don’t have to either. Whether you’re fixing sudden damage or planning essential upgrades, our lending partners provide flexible funding for a range of home repair needs, including:

- Roof repairs or replacements

- Plumbing emergencies

- Electrical rewiring or fault fixes

- Broken heating or air conditioning systems

- Window and door replacements

- Structural damage repair

- Water damage restoration

- Pest control and prevention

- Foundation or basement repairs

- Emergency mold removal

- Accessibility modifications (e.g. wheelchair ramps)

Reviews

Diana P., Baton Rouge, LA5: “After a tree crashed through my roof during a storm, I didn’t know where to turn. My credit isn’t great, and my usual bank wouldn’t help. Yup Loans connected me with a lender the same day, and I had money in my account by morning. The whole process was stress-free and fast.”

Keith M., Cleveland, OH5: “When my water heater broke in the middle of winter, I couldn’t wait weeks for a repair. I applied with Yup Loans, and within hours, I was reviewing offers. Even with my bad credit history, I got a loan with terms I could manage.”

Home Repair Loans for Bad Credit FAQs

Can I get a home repair loan with bad credit?

Many of the lenders in our network specialize in working with people who have poor credit histories and don’t have a minimum credit score requirement. Instead of focusing only on your credit score, they’ll consider your income and ability to repay the loan³.

How fast can I receive the funds?

Most loans are funded by the next business day after approval*. In some cases, if you complete your application early and provide any required documents promptly, same-day funding is possible, which is ideal for urgent repair situations.

What types of repairs can I use the loan for?

These loans are flexible. You can use them for any home-related repair, including plumbing issues, roof damage or HVAC repairs. If you are doing the repairs yourself, you can use the funds to buy materials.

Do I need to show proof of repairs?

Most lenders won’t ask for estimates, receipts, or proof of how the money is used. They care more about your ability to repay the loan, not how you choose to use the funds.

Fix Your Home Sooner, Even with Bad Credit

Bad credit doesn’t have to mean living with broken fixtures or unfinished repairs. With Yup Loans, you can apply online in minutes¹ and get a quick decision. Get back to living comfortably with a home repair loan that works for you.